12 Types of Accountants: Unveiling Specializations in Accountancy

In the intricate world of finance, the role of accountants goes beyond mere number-crunching. As financial landscapes evolve, so do the specializations within accountancy. In this comprehensive guide, we delve into the 12 types of accountants, unveiling their unique roles and contributions across different areas of accountancy.

1. Public Accountants: Beyond the Basics

Public accountants serve a crucial role in providing a range of financial services to individuals, businesses, and organizations. Their expertise extends to auditing, tax preparation, and consulting, offering a comprehensive financial approach.

2. Management Accountants: Navigating Strategic Financial Decisions

Management accountants, often referred to as cost, corporate, or private accountants, focus on internal financial processes. Their insights drive strategic decisions by providing crucial financial information to guide management in making informed choices.

3. Government Accountants: Ensuring Fiscal Responsibility

Government accountants work within public sector agencies, ensuring compliance with regulations and managing financial records. Their role is pivotal in upholding fiscal responsibility and transparency in government operations.

4. Forensic Accountants: Unraveling Financial Mysteries

In the world of financial investigations, forensic accountants play a key role. They utilize accounting skills to uncover fraud, embezzlement, and financial discrepancies, acting as financial detectives within legal contexts.

5. Auditors: Guardians of Financial Accuracy

Auditors play a critical role in ensuring the accuracy and transparency of financial records. Whether internal or external, auditors meticulously review financial statements, offering assurance to stakeholders about the reliability of financial information.

6. Tax Accountants: Navigating the Complex Tax Landscape

Tax accountants specialize in tax preparation and planning, helping individuals and businesses navigate the complex and ever-changing tax landscape. Their expertise ensures compliance while optimizing tax benefits.

7. Cost Accountants: Enhancing Cost Efficiency

Cost accountants focus on analyzing and optimizing costs within an organization. Their insights help streamline operations, enhance efficiency, and contribute to better financial decision-making.

8. Project Accountants: Managing Financial Aspects of Projects

In project-based industries, project accountants play a vital role in managing the financial aspects of specific projects. From budgeting to financial reporting, their expertise ensures projects stay on track financially.

9. Environmental Accountants: Integrating Sustainability

As businesses embrace sustainability, environmental accountants play a crucial role. They focus on integrating environmental considerations into financial decisions, contributing to a more sustainable and responsible business approach.

10. Nonprofit Accountants: Navigating Financial Challenges for Good Causes

Nonprofit accountants operate within the unique financial landscape of nonprofit organizations. Their expertise includes managing donations, grants, and compliance with nonprofit regulations.

11. International Accountants: Bridging Global Financial Practices

In an increasingly globalized world, international accountants navigate the complexities of international financial regulations. Their expertise is crucial for businesses engaging in global transactions and operations.

12. Tax Compliance Specialists: Ensuring Adherence to Tax Laws

Within the realm of tax, compliance specialists focus on ensuring adherence to tax laws and regulations. Their role is pivotal in avoiding legal complications and maintaining ethical financial practices.

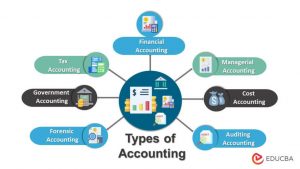

Diagram: Types of Accountants

In conclusion, understanding the diverse specializations within accountancy is crucial for businesses and individuals seeking financial expertise. Each type of accountant plays a unique role, contributing to the broader landscape of financial management. Whether you’re looking for tax advice, forensic analysis, or sustainable financial practices, there’s a specialized accountant ready to meet your specific needs.